Host Merchant Services is a well-known company in merchant services. It offers credit card processing systems for all types of payments. This includes e-commerce, virtual, point-of-sale, mobile, and more. The company specifically promotes its services, products, and solutions for high-risk and small businesses.

Below is an overview of merchant services offered by Host Merchant Services:

Host Merchant Services provides merchant accounts for businesses. It offers two types of accounts – interchange-plus and cash discount. An interchange-plus account follows the standard pricing of most providers. It includes a processing fee and a markup for the provider’s services.

Its advantage is lower fees compared to flat-rate and tiered pricing schemes. A cash discount account is another option for even more savings. With this merchant account, businesses are not charged with any processing or transaction fees. Instead, they are shouldered by the customers.

From these two options, Host Merchant Services will recommend a suitable merchant account. It also customizes other solutions and rates depending on the merchant’s needs. The company also guarantees quick funding and no binding contracts.

Host Merchant Services offers payment gateway integrations for Authorize.net, Transaction Express, and more than 100 other options. It also provides payment processing systems like a virtual terminal for MOTO merchants, physical point-of-sale terminals for retail merchants, and wireless terminals for mobile merchants.

The latter can also integrate their existing smartphone or tablet with the company’s HMSPay app. Options for physical terminals include SwipeSimple, PAX, Vital POS, Clover POS, and more. The company’s systems come with enhanced features like recurring billing, check imaging, online reports, and analytics.

At the core of the company’s payment systems are its payment processing capabilities. Merchants can accept credit cards, debit cards, ACH payments, and check payments. The company also supports payments through loyalty cards and gift cards. Additionally, merchants that are registered as SNAP retailers can accept EBT payments.

For e-commerce merchants, Host Merchant Services can help you integrate an online shopping software that works best with your chosen payment system. For those with an existing shopping cart, the company offers easy integrations with WooCommerce, Shopify, Magneto, BigCommerce, Wix, 3dcart, PinnacleCart, and XCart. It also has API integrations for shopping carts not found in this list.

Merchants will have access to fraud prevention features like tokenization. The company’s payment systems are also PCI compliant to assure merchants of security standards.

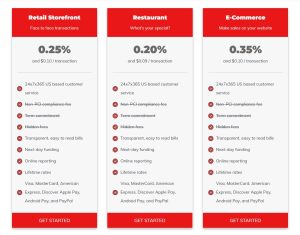

Processing Fees –

Below is a list of processing fees and rates stated on the Host Merchant Services website. The company promises savings through its services. Otherwise, it guarantees a $50 token to merchants.

Host Merchant Services also offers a small ticket program. Qualifying merchants get an interchange rate of just 1.6% plus $0.05 for Visa and 1.55% plus $0.04 for MasterCard.

Additional Fees –

Host Merchant Services offers free setup and termination. Merchants are not bound to a lengthy contract and can cancel anytime without penalties. Furthermore, it does not charge for PIN debit and address verification. Below is a list of declared additional fees as seen on its website:

Hidden Charges –

Host Merchant Services guarantees no hidden fees.

Host Merchant Services has a few complaints in Consumer Affairs and BBB. Most of them have a 3-star rating and do not mention any major issues or losses. Below is a summary of complaints. (Xanax)

None of the complaints are related to the company being a rip-off or scam.

There are currently four complaints about the company’s payment systems. One mentioned an integration problem between his existing payment systems and the company’s physical terminal. Another complained about the absence of MasterCard and Visa on its website. In both cases, they claim that customer support could not help fix the problem.

The third complaint was about the limited use of his credit card terminal. However, it seems to be related to his customers’ preferences rather than a technical problem.

The fourth complaint is from the BBB website. The merchant claimed that the company’s services were not compatible with his business model. He was asked to close his account after they had already agreed on the terms. Host Merchant Services replied to the complaint and attributed the problem to the bank. The issue was settled as the company opened a new account for the merchant.

Host Merchant Services has been accredited by the BBB since 2011. It currently holds an A+ rating.

The company has no BBB reviews. It has one customer complaint included in the Complaints section above.

Host Merchant Services is a legitimate company established in 2008 by Lou Honick. It has offices in Newark and Delaware. It has a strong online presence, which further attests to its credibility. It appears on several independent review sites, all of which gave it positive ratings. Its website also contains information about its executive team, existing merchants, and contact details.

Host Merchant Services has numerous customer reviews across different platforms. It has generally high customer ratings, save for the few complaints mentioned above. It has a 4.7-star rating on Trustpilot, a 4.7-star rating on Google, and a 4.8-star rating on Consumer Affairs. Its website also features testimonials from satisfied clients.

In summary, merchants highlight the company’s end-to-end solutions, reliable customer service, fast approvals, and account setup. Many share positive experiences and accomplishments with the company. The company also appears on several independent review sites with a rating of 4.8 to 5 stars. They confirm the company’s robust services, credibility, and clean record. However, some mention that the company may have high rates for merchants with lower volumes.

Host Merchant Services seems to be a reputable company in the industry. It offers a wide variety of payment processing solutions for all types of merchants and industries. Its no-contract partnership and transparent pricing are attractive come-ons as well. Overall, the company is worth considering especially for high-risk merchants in need of specialized services.