Blue Wave Merchant Solutions provides credit card processing solutions to high-risk merchant clients. No matter what type of high-risk business you run, Blue Wave Merchant Solutions has the payment solution to meet your requirements.

With more than a decade of experience in providing payment processing solutions to high-risk e-commerce merchants, the company prides itself on accommodating businesses not served by traditional payment processors.

High-risk merchants have a hard time running their operations if no payment processing companies can take the risk for them. Blue Wave Merchant Solutions provides an easy and fast turnaround time, so its clients can move past their problems with payment processing.

Blue Wave Merchant Solutions offers credit card processing for in-person and online businesses. It provides point-of-sale systems, countertop credit card machines, and online gateways to online businesses so these companies can accept online credit card payments.

It is also a credit card payment processor for regular industries not considered high-risk, but it specializes in businesses that have a hard time receiving and processing credit card payments because of the risks their industries carry.

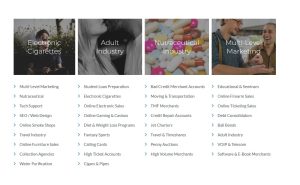

Many legitimate businesses don’t have access to credit card processing solutions because they are considered high-risk. These companies are involved in adult entertainment, smoke and vape sales, travel, fantasy sports, gambling, adoption, and firearms. Blue Wave Merchant Solutions is especially focused on providing payment solutions to these industries.

High-risk businesses are also operating online. In fact, online is where they have grown their businesses. And yet, many of them are having a hard time getting approved for payment gateways because of the products and services they offer. Blue Wave Merchant Solutions ensures the security of the payment gateways, so clients and customers are assured that their information will not fall into the wrong hands.

Blue Wave Merchant Solutions also has a computer-based electronic network for processing transactions, including check payments. It can process these deposits automatically and in real-time on any computer or device and from anywhere in the world. Blue Wave Merchant Solutions boasts of its ability to verify payments in real-time, as well as its easy-to-use software, recurring billing, and 24/7 technical support.

All businesses must have the ability to process mobile payments such as mobile wallets and smartcards. For this to be possible, businesses must have mobile point-of-sale-ready terminals. These will empower businesses to accept all kinds of payments—cash, credit card, and mobile wallets—to make it easy and convenient for customers to pay for their purchases.

Blue Wave Merchant Solutions can turn any computer into a virtual terminal. This means that your business will be able to use your computer to process credit card payments over the phone. This is the perfect option for those who also receive payments over the phone aside from online payment processing.

There is no information on Blue Wave Merchant Solutions’ website about how much it charges clients to process payments. Most merchant service providers, like Blue Wave Merchant Solutions, impose a 2.9% charge for every credit card process.

But this also depends on the service agreement entered with the merchant service provider. Most businesses do not want to impose an automated percentage on their customers because this scheme turns clients away. Instead of an automated percentage, you can work out a fixed rate with Blue Wave Merchant Solutions.

Like other merchant solutions, Blue Wave Merchant Solutions has to consider a host of other factors before it can compute the final price offer to clients. These factors will be based on volume and payout schedules. Any additional fees will also likely depend on the risk that Blue Wave Merchant Solutions will take to process payments made to your business.

There is no report of hidden charges Blue Wave Merchant Solutions imposes on its clients.

There is no mention of any rip-off reports involving Blue Wave Merchant Solutions. Clients are quick to complain about companies they feel are ripping them off, so since there are no reports on the internet, it might be because clients are satisfied with Blue Wave Merchant Solutions’ services.

There are no complaints about Blue Wave Merchant Solutions. Even on other merchant review sites, there is no mention of fraud or other similar complaints against the company.

There is no record of Blue Wave Merchant Solutions on the Better Business Bureau (BBB) website. There is a company called Blue Wave Solutions on BBB, but the bureau said it is not BBB-accredited. It is not clear if this company and Blue Wave Merchant Solutions are one and the same.

Another merchant review website shows Blue Wave Merchant Solutions with a 4.7 rating, though that’s only one vote. But the lack of reviews about Blue Wave might be because it’s still a relatively young company. It was only founded in 2016. It still has no Google, Facebook, or Yelp reviews.

A look into its website, however, shows a “what our clients say” section. Most of the testimonials said that Blue Wave Merchant Solutions helped their businesses and it has the best rates among other merchant services.

Blue Wave Merchant Solutions has a “what our clients say” section on its website. In these testimonials, all the clients say that the company is transparent. They also said that Blue Wave Merchant Solutions helped them understand what they need to do to keep their business in good standing. They also espoused the company’s transparency and fair rates.

Blue Wave Merchant Solutions offers end-to-end solutions for your payment processing needs. If your business is part of the high-risk industry, Blue Wave Merchant Solutions is a possible good partner to serve your needs and help you grow.

Overall, Blue Wave Merchant Solutions looks like a legitimate company that offers valuable services to its clients. But as always, it’s better to be prudent when signing up for any merchant services.