CryptoBucks empowers businesses to accept cryptocurrencies, such as Bitcoin, Litecoin, and Ethereum. The system can instantly convert the cryptocurrency payment into dollars. More than that, the company can also process traditional payments such as debit cards, credit cards, checks, and cash. CryptoBucks has a state-of-the-art point-of-sale (POS) device and software with built-in Wi-Fi, 4G, GPS, and NFC technology.

If your business already has existing equipment, you can upgrade, exchange, or integrate CryptoBucks. The team can reprogram the equipment to start accepting cryptocurrency and allow customers to pay however they like, including EMV, NFC, Mag Stripe, PIN debit, and gift cards.

CryptoBucks is proud of what it can bring to the table:

It provides payment gateways, POS devices, crypto payment systems, and many more. The company is also a high-risk payment processing service provider. CryptoBucks specializes in customizable innovative payment solutions that can bring your business to new heights.

Businesses need to start accepting credit card payments as soon as it opens. Without card payments, companies will have a hard time expanding their market and increasing sales. CryptoBucks can accept most cards, such as Visa, Mastercard, AMEX, and Discover.

CryptoBucks can also process payments for high-risk industries. These are the types of businesses it can work with:

CryptoBucks is unique because it accepts cryptocurrency. Merchants can start processing crypto payments and convert those into dollars via the app. The setup is easy, and the software can be integrated into various devices and platforms. It can accept Bitcoin, Ethereum, Litecoin, Bitcoin Cash, and XRP Ripple.

CryptoBucks can also provide mobile and handheld terminals, such as the PAX A920, PAX A60, and PAX A80. This means businesses can accept payments no matter where they are. These devices will enable them to join trade shows and exhibits and receive orders and payments from clients off-site.

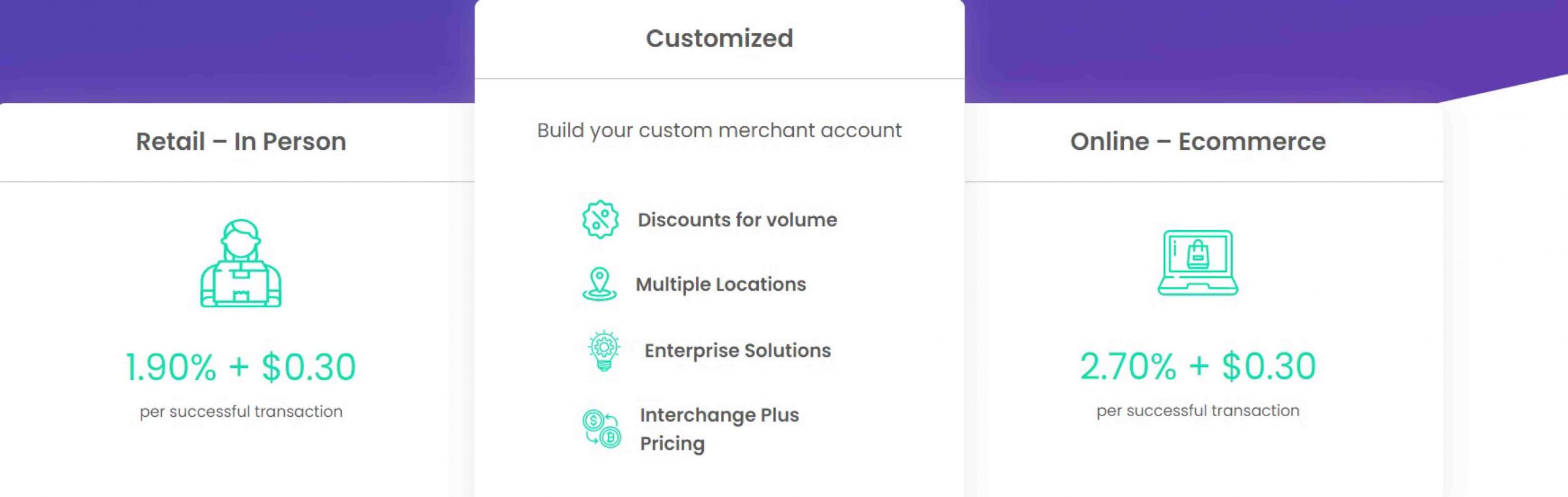

The CryptoBucks is free to download. Once you have set up an account through the app, you can choose two different plans: retail in-person and online e-commerce. For in-person transactions, the fees are 1.90% plus $0.30 per transaction. For online, it is 2.70% plus $0.30 per successful transaction.

There is no monthly fee, recurring billing fee, invoicing, or equipment lease. The fraud protection fee is $10 a month.

CryptoBucks has additional fees. These are as follows:

You can get the add-ons as a bundle with a $39.95 discounted price. For that, you will get a payment gateway, fraud detection, recurring billing, and customer care storage.

Merchants can have the pricing customized, too. CryptoBucks offers discounts for volume, enterprise solutions, and interchange-plus pricing.

CryptoBucks says it is fully transparent and has no hidden fees.

There are no significant complaints about CryptoBucks. At least one customer review of the app questioned the need to divulge personal and financial information upon signing up.

There are no rip-off reports about CryptoBucks.

There are no other complaints about CryptoBucks.

CryptoBucks is not listed with the Better Business Bureau (BBB). It is not accredited and rated by BBB as a payment processing solution provider.

The BBB is an association that accredits and rates payment processors based in the United States, Canada, and Mexico. Many merchants check the BBB website before partnering with a payment processor to ensure the company’s legitimacy. However, it should be noted that BBB is not the only group that accredits payment processing companies.

There are no reviews about CryptoBucks on the BBB website.

Although CryptoBucks is not listed on the BBB website, it has a well-updated website. It also has a profile page on Twitter that’s been up since May 2013. It has more than 12,000 followers on its social media page. The last update was on Feb. 18, 2022. Upon further inspection, the company replies, tweets, and retweets Twitter content.

ScamAdviser cannot access the website, so it cannot determine if it is a scam or not. But from what can be found on the internet, the company looks legitimate enough and widely used in the cryptocurrency industry.

There are no scam reports about CryptoBucks.

No information says CryptoBucks is facing any kind of lawsuit.

Unlike other high-risk payment processing solution providers, CryptoBucks does not publish client testimonials on its website. There is also no mention of it on common review sites. It does not have a Facebook page where customers can leave testimonials, recommendations, and reviews.

However, its app page on Google has several reviews. Some merchants said the app has a clean interface. Some say it is the easiest way to accept cryptocurrency for any business. One reviewer said the CryptoBucks app should be more upfront about asking for banking information. The review also noted glaring grammar errors in the app’s description and the frequently asked questions (FAQ) section.

It is difficult to recommend CryptoBucks when there are not many online reviews about it. Customers are not leaving reviews about the app, making it hard to rely on what the company’s website says. However, there are no complaints or scam reports about the app. It also has a downloadable app that you can remove whenever you want. So far, the app has been downloaded more than 100 times.