Maverick BankCard offers payment processing that’s driven by technology. While the company serves a range of industries, it focuses on high-risk merchant accounts. Maverick BankCard has a long history, working with tens of thousands of merchants since 2000.

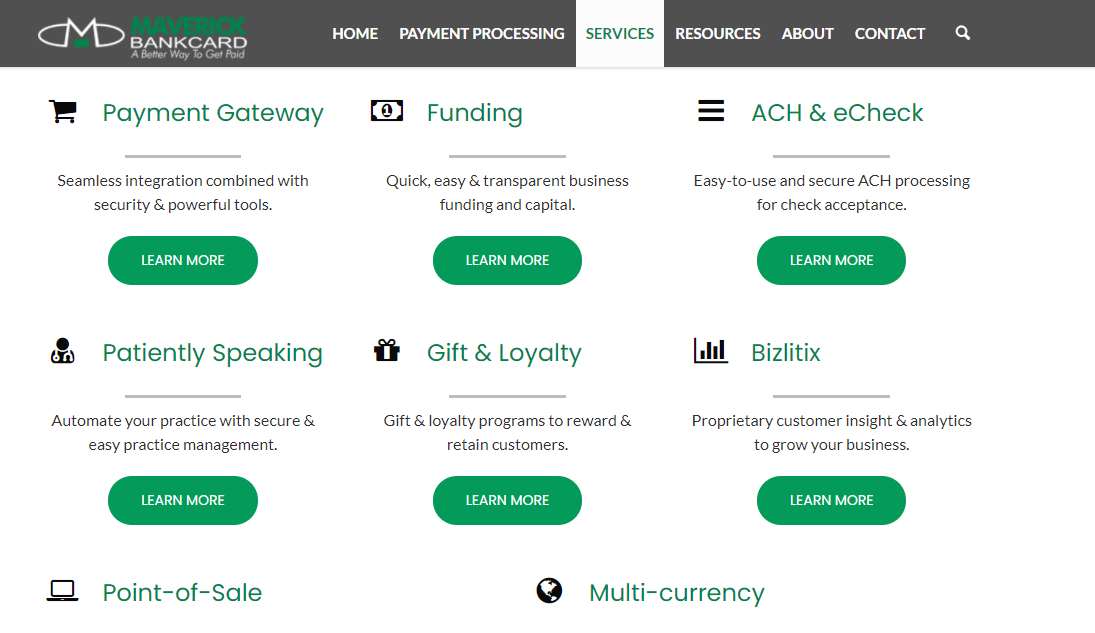

The services from Maverick BankCard revolve around its payment processing offerings. In addition to high-risk credit card processing, it also offers ACH processing.

Explore some of the services from Maverick BankCard in more detail.

High-risk credit card processing from Maverick BankCard lets you accept MasterCard, Visa, American Express, and Discover. You can also process ACH transfers.

Retailers with physical stores also receive signage advertising for the credit cards accepted at their locations.

High-risk merchant accounts can also be set up and use both loyalty programs and gift cards.

The Maverick BankCard payment gateway is highly secure and versatile. It integrates with more than 100 CRM systems, software programs, and shopping carts. B2G and B2B businesses can also take advantage of Level 2 or 3 processing.

Clients can take advantage of the physical POS systems that Maverick BankCard offers.

If you already have a POS system, Maverick BankCard is likely compatible with it.

The virtual terminal allows for high-risk credit card processing when the card is not present.

This feature helps merchants maintain up-to-date records. As a bonus, the batching has an extremely late cutoff of 11 pm Eastern for qualifying merchants.

With Maverick BankCard, e-commerce businesses can also take advantage of direct deposits.

Like most payment processors, Maverick BankCard gives high-risk merchant accounts access to reports. These reports include analytics and insights that you can use to improve your business.

The reports contain information on reserves, chargebacks, statements, batches, and authorization. Each of these reports is highly detailed. For example, the authorization report lists brand, card, response, amount, and timestamp.

Some of the information you can view in the fraud analysis tools on the dashboard include BIN-based authorization status for domestic versus foreign cards, brands, card types, and more. This section also includes the reasons for chargebacks.

It also includes a negative chargeback system that lets you know about risky payments.

Both merchants and partners can use the API to integrate Maverick BankCard’s services with their products and services. You can also request sandbox access.

These business analytics let high-risk merchant accounts better understand their customers, competitors, and business. It includes keyword research, online reputation management, website analytics, payment processing trends, and a heat map of visitor activity.

The Maverick Analytics portion of Bizlitix provides incredibly useful data. This includes what returning customers buy, how often they buy it, revenue trends by card type, personal versus business credit card usage, and when your “rush hour” is. The Site Analytics is also very helpful for e-commerce, letting you see the demographics and location of visitors.

You can also take advantage of white-label programs for financial institutions, software companies, agents, and independent sales agents.

The partner program lets partners earn commissions. It includes branding and a streamlined onboarding process. Partners also receive residuals and sub-agent users.

Although high-risk businesses are unlikely to need this feature, Maverick BankCard supports the processing of fuel and fleet cards, which helps gas stations. It also offers Automated Fuel Dispenser (AFD) processing.

Maverick offers services specific to the health care industry, such as appointment reminders via PatientlySpeaking. It also offers HIPAA coverage and compliance, patient recall reminders, and the Patient A/R Platform.

Maverick prides itself on giving high-risk merchant accounts transparent pricing. Instead of listing pricing on its website, Maverick BankCard customizes its pricing based on your company’s scope, size, and other requirements.

No Obligation Analysis

If you already have a payment processing system in place, Maverick BankCard can evaluate it to look at potential savings. The assessment comes without any obligation.

Maverick BankCard works with companies in high-risk industries as well as those with high-volume transactions. They also work with businesses of all sizes. The high-risk sectors that Maverick BankCard specializes in include:

Take a closer look at some of the other features that set Maverick BankCard apart from the competition.

Maverick BankCard prides itself on its cutting-edge proprietary technology. That technology is what delivers the advanced reporting with actionable insights and analytics the company offers. It is also how Maverick BankCard provides chargeback management and fraud prevention.

Maverick BankCard has a team of more than 10 full-time developers and uses multiple hosting providers to deliver 99.999% uptime.

The Maverick BankCard payment processing system integrates with plenty of third-party software, including CRM programs. Overall, Maverick BankCard supports thousands of integrations, from shopping carts to CRM systems to other types. There are even integrations that let their services work seamlessly with hotels and restaurants’ existing software.

The underwriting for high-risk merchant accounts from Maverick BankCard takes place in-house. This allows for a quick review of your application. It also helps ensure that merchants know what information and documents they need and can ask questions about the requirements if necessary.

In addition to in-house underwriting, every other part of the payment cycle is managed in-house at Maverick BankCard. This simplifies risk management and improves service.

Customers can contact customer support any time of the day, every day of the year.

With a client-centered model, Maverick BankCard makes customers its focus. This is part of the company’s efforts to ensure customer satisfaction.

That customer-centric approach also means that Maverick BankCard offers solutions that are specific to your particular industry.

This high-risk credit card processing company delivers the highest security levels. They even offer $100,000 PCI coverage for breaches.

The equipment Maverick BankCard provides is PA-DSS- and PCI-DSS compliant. The facility is PCI Level One-compliant. The dashboard hosting from Maverick BankCard is also SOC 2 and HIPAA-certified. On top of that, Maverick is a validated service provider for both Visa and MasterCard.

Maverick BankCard is family-owned and operated, a rarity in payment processing. This influences the company’s commitment to building long-standing personal relationships with partners and merchants.

Maverick BankCard has been in business since 2000. Since then, it has helped more than 80,000 merchants. Maverick BankCard uses that experience to deliver solutions that merchants need as well as excellent customer support.

Maverick BankCard also works to reduce its environmental footprint. This is done via sustainable operations and green supplies.

With more than two decades of experience and high-risk credit card processing solutions that integrate with hundreds of shopping carts and CRMs, Maverick BankCard is worth the consideration. It specializes in high-risk clients but also works with non-high-risk industries. The company’s prices and services are flexible to meet your specific needs.