PaymentVision is a division of the Autoscribe Corporation. It claims to be an industry leader in financial technology. It offers a PCI-certified payment gateway to process credit card payments for merchants. The software will enable businesses to accept payments via their own call center, automated phone systems, web, and integrated software payment API.

It works with collection agencies, law firms, and even health care. Aside from payment processing, PaymentVision can also streamline business processes through its bill collection features. This will help merchants keep tabs on their receivables. It provides an administrative portal from which merchants can centralize all payment-related activities. PaymentVision can help in account research, risk management, and real-time reporting.

PaymentVision will provide the tools so merchants can start accepting debit and credit card payments. Businesses can accept card payments through phone, text, online, and at stores. The company also has a downloadable mobile payment app for this. It also prides itself on being PCI DSS compliant. This compliance ensures that the payment gateways are secure for all kinds of transactions.

The company can work with collection agencies, government, and law firms. These are considered high-risk by traditional payment processors. PaymentVision can set up a payment gateway for these businesses to start accepting payments safely. It also offers financial services to auto finance, consumer finance, and insurance.

Businesses need to start accepting direct bank payments. An automated clearinghouse or ACH does that for you. It can turn checks into direct bank deposits. This way, businesses won’t have to wait for customers to mail their check payments. Also, merchants can use ACH to pay their suppliers.

PaymentVision also provides virtual terminals. This means that merchants can process card payments over the phone. It allows customers who cannot transact online to call the company and pay for their purchases by talking with a qualified representative. The virtual payment portal can also set up scheduled or recurring billing.

There isn’t a lot of information about the company’s pricing, fees, and charges. PaymentVision has not published its fees on the website. A review site posted a cost summary for the company. The swiped and keyed-in rate is between 1% and 4.99%. There is no early termination and PCI compliance fee. The PaymentVision website also claims that there is no hold or reserve requirement, and application and setup fees.

There is no information about PaymentVision’s additional fees.

There is also no information if PaymentVision has hidden charges.

There are less than 10 complaints that can be found about PaymentVision. The company has a fairly good reputation among merchants and clients. One complaint alleged that the software was not developed in-house.

There aren’t many rip-off reports about PaymentVision. One unverified review said that it has ridiculous fees.

Aside from those mentioned above, there are no other complaints against PaymentVision.

The Better Business Bureau (BBB) accredits and rates companies based s in the US, Canada, and Mexico. Businesses can get a rating as high as A+ and as low as F. Although the company has a page on the BBB website, it is not accredited by BBB. It also has an “NR” rating, which means no rating.

There are no reviews or complaints on the BBB website about PaymentVision.

PaymentVision is an industry leader in payment gateway and payment processing solutions. It has positive reviews in online forums and review sites. It is also PCI compliant to secure the information passed between merchants and customers. It was even named a top electronic payment solution by Collection Advisor Magazine.

PaymentVision’s website has a perfect trust rating of 100 on ScamAdviser. The scam checker said the good trust score is because the web owner has claimed the domain name for a long time and the site has existed for quite some time. The website is also receiving a lot of traffic.

The company has a legitimate Facebook profile that’s updated regularly. The last update on the site was last December 10.

There are no scam reports about PaymentVision.

There are no lawsuits filed against PaymentVision.

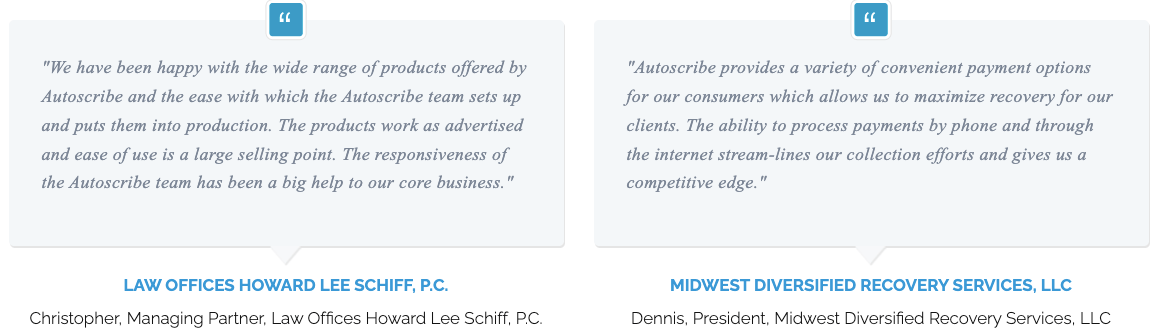

The company publishes client testimonials on its website. Merchants said that PaymentVision’s software is easy to integrate into their existing systems. Many of them have been a partner of the company for years. One customer said he has been working with PaymentVision for 20 years.

The reviews said that PaymentVision provides the tools to streamline their business processes. They were able to save time and money because of the company. The clients also raved about the excellent customer service of PaymentVision. Their issues were addressed immediately.

PaymentVision receives plenty of compliments even in online forums and reviews sites. Many clients talked about how the software helped their small businesses. They were able to expand their reach because of the tools provided by PaymentVision.

There is no reason why merchants should not work with PaymentVision. It is not only a legitimate company, but it is one of the best in the industry. It provides tools to help your businesses reach new heights. Past and present clients are raving about how the company helped them streamline processes.

If you are looking for a PCI-compliant payment processor, PaymentVision is the most practical solution. It makes payments easier. On top of that, it provides the necessary tools for alternative payment options.