Pro Merchant, also written ProMerchant, offers high-risk merchant accounts and credit card processing with a straightforward pricing structure.

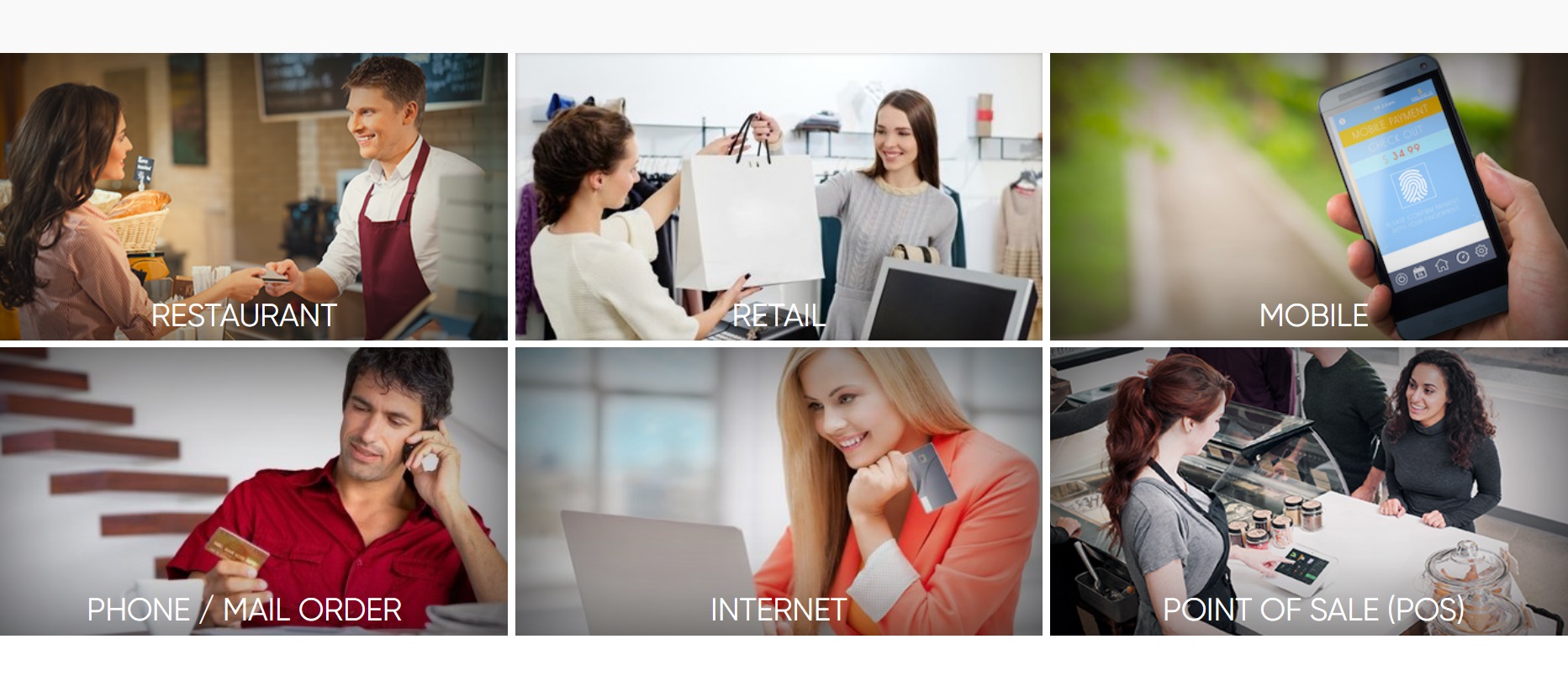

With ProMerchant high-risk merchant accounts, you can take advantage of payment processing via a virtual terminal, mobile devices, or a traditional POS machine. The company has a range of terminals for clients to choose from.

The following takes a closer look at the services available for high-risk merchant accounts.

If you have a physical store, then you will likely want one of the company’s POS systems. Retailers and restaurants can opt for the free credit card terminal that is EMV/NFC capable. It also has a lightning-fast processing speed. Or you can opt for an EMV/NFC-ready POS system that has additional apps and functions that you need to run your business.

There are terminals of varying sizes available, including handheld or highly portable options. Most stores will choose between the free Verifone VX520 terminal for credit cards and the free PAX A920 with a 5-inch screen and card slot. It uses 4G or Wi-Fi.

There are also various Clover terminals to choose from, including the all-in-one Clover Station, Clover Mini, and Clover Flex.

The high-risk credit card processing services include a free Bluetooth card reader that works with the free PayAnywhere app and is EMV/NFC-ready.

The app is fully featured, including the ability to leave tips, view transaction history, and text or email receipts. You can also view the information on the PayAnywhere website if you prefer not to view it on a mobile device. The website also allows you to export the data into accounting software.

The Payments Hub virtual terminal lets you accept payments with a buy now button or shopping cart on your e-commerce website. Or you can use it to accept payments by text, email, or phone. It has no upfront cost.

The virtual terminal also includes full transaction management, including reports. It also connects to the Payments Hub website for merchant account management.

High-risk credit card processing can be done via Authorize.Net, a payment gateway. It includes easy invoicing, automatic recurring billing, QuickBooks Sync, and a virtual terminal.

ProMerchant prides itself on offering transparent pricing plans that deliver cost savings. There are no fees for the application nor for the setup process. There are also no early termination fees.

You can choose from two pricing models with Pro Merchant. This lets high-risk merchant accounts decide which model is the most cost-effective for them based on average monthly sales, charge volume, and credit card acceptance methods.

The interchange plus fixed rate fee has you pay a fixed percentage rate and fixed transaction fee. It comes with low monthly fees. Importantly, the transaction fee and percentage rates are fixed. This means that ProMerchant will not raise them, even if their costs increase.

If you prefer, you can opt for a flat rate for all transactions. This method does not have any membership or subscription fees. You pay a flat percentage rate and flat transaction fee for all cards. That eliminates the high fees that are common for reward cards.

As is common in the industry, ProMerchant requires you to contact them for a free quote. This lets them customize their rates to your business.

Next-day funding is available for transactions that settle before 8:30 p.m. Eastern time.

Just some of the industries that Pro Merchant offers high-risk credit card processing to include:

Other Notable Features of Pro Merchant

Other Notable Features of Pro MerchantOpening a high-risk merchant account with Pro Merchant also gives you access to the following features.

As is expected from high-risk credit card processing, the software includes reporting tools and analytics. These are designed to be easy to use and provide valuable information.

Instead of a long-term contract like what many competitors require, Pro Merchant has a month-to-month agreement. This lack of long-term commitment gives you more flexibility. It also eliminates early termination fees.

The customer support from ProMerchant includes a personalized support team. This comes via your own dedicated support team, so you are always able to get support from someone you are familiar and comfortable with.

The application process is easy and quick to complete, getting you on your way to payment processing soon. The design of the application and ProMerchant’s processes also let the company approve you within a few days, sometimes within just two hours.

Most accounts are approved within 24 hours, letting mobile and retail merchants start processing cards within 72 hours of contacting ProMerchant. Merchants that accept payments over the internet, mail, or telephone can start accepting credit cards within just 48 hours of contacting the company.

ProMerchant works with 12 high-risk processors. This variety makes it possible for them to accept a range of high-risk businesses.

High-risk merchant accounts can start accepting payments the day after their application is approved. This comes from next-day access to the ProMerchant online processing solutions and overnight delivery of the terminals.

ProMerchant has such a strong reputation that it won the title of Best Credit Card Processor from PaymentProcessing.com in 2019, 2020, and 2021. It also has high ratings from customers and third-party reviewers alike. For example, it has a 4.5 on Trustpilot and a 5-star rating on Card Payment Options.

Reviews praise the company’s ease of use, the helpfulness and promptness of staff, pricing transparency, quick approval, and the simplicity of setting up the services.

ProMerchant offers high-risk credit card processing to a range of industries. Uniquely, it lets merchants choose from two pricing structures. The company is highly rated and has an incredibly quick approval process. This, combined with overnight terminal delivery, lets you start accepting payments within days of submitting your application. The customer support is also excellent, with many clients praising the team for their responsiveness and helpfulness.