Payvea aims to provide flexible, transparent, and secure payment systems to help businesses manage their transactions and grow profits. It works with all types of businesses — from low-risk to high-risk. Small and large businesses can find a payment solution they need in Payvea’s array of products and services.

The company offers the following products and services:

It also has a partner program to connect merchants with third-party service providers. Payvea is looking to partner with application software developers, shopping cart vendors, agent banks, web hosting, domain registrars, web designers, and consultants to provide such services to its clients.

Payvea promises to be with its clients every step of the way. It can find payment solutions for all your business needs. The rates are competitive and flexible enough to be customized. The company aims to help its clients maximize their profits at the lowest cost possible.

Without card payment processing, businesses will have a hard time growing. That’s what Payvea will bring to the table. It provides the necessary tools, apps, and software for businesses to process card payments. It is accredited by Visa, Mastercard, Maestro, American Express, JCB, Discover, Diners Club International, iDeal, GiroPay, and Sofort Banking.

Many entrepreneurs cannot get approval from regular banks because of the nature of their businesses. These so-called high-risk industries will involve higher rates compared to standard-risk companies. Payvea can provide a merchant account for the following sectors:

Payvea also offers a secure payment gateway to enable businesses to transact payments via phone or online. The gateway secures the connection between the merchant, client, and the bank. Here are the features of Payvea’s payment gateway:

With its mobile credit card processing solutions, Payvea can allow businesses to accept payments whenever and wherever. This means you can attend trade shows, exhibits, and other outdoor events. The system also comes with online account management and reporting. Plus, it is compatible with almost all devices.

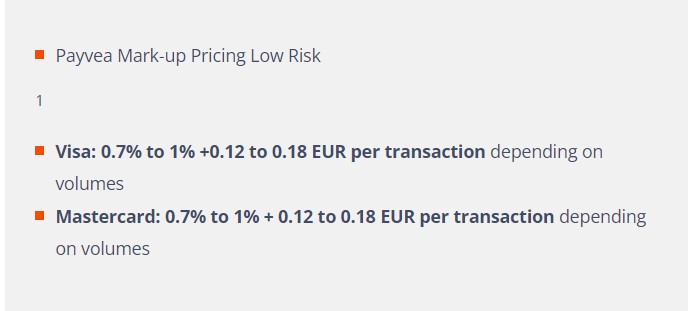

Payvea has a different pricing scheme for low-risk and high-risk merchants. For low-risk merchants using a Visa card, the pricing would be 0.7% to 1% +0.12 to 0.18 EUR per transaction, depending on volumes. For Mastercard, the scheme would be 0.7% to 1% + 0.12 to 0.18 EUR per transaction, depending on volumes.

For high-risk merchants, the fees are slightly higher. For Visa, it would be 1.5% to 1.8% + 0.20 to 0.25 EUR per transaction depending on volumes. For Mastercard, it would be 1.5% to 1.8% + 0.20 to 0.25 EUR per transaction depending on volumes.

There is no information about Payvea’s additional fees.

It doesn’t look like Payvea has hidden charges.

There are no recorded complaints about Payvea.

There are no rip-off reports about Payvea.

There are no other complaints about Payvea.

Payvea is not accredited by the Better Business Bureau (BBB). The bureau accredits payment processing companies in the United States, Canada, and Mexico. It also has no rating by the bureau.

Sometimes, merchants want to check the payment processor’s BBB rating before considering the company. However, the BBB is not the only association that accredits and rates payment processors.

Since Payvea is not accredited and rated by the BBB, there are no reviews and complaints about it on the bureau’s website.

Payvea has Facebook and LinkedIn profiles. However, the last time it updated its profile on Facebook was in May 2020. It also only has 48 followers.

ScamAdviser also only gave it a fair trust score of 66/100. While it is safe to browse the site, merchants should still be wary of potential scams. These are the positive highlights of the website:

There are also a lot of negative highlights about the website. First, the identity of the owner is hidden. Second, it has a low Alexa rank. Third, there are not many backlinks to the site. And finally, there are no popular reviews about it.

There are no scam reports about Payvea.

Payvea is not facing any lawsuits.

Unfortunately, Payvea doesn’t have any customer reviews on popular review sites. It also does not have client testimonials published on its website. It has no reviews and zero recommendations on Facebook.

It is a bit hard to recommend Payvea when there isn’t much information about it on the internet. All you’ll be able to find are the details about its services on the company’s website. You can always still reach out to inquire and ask for quotations. Although ScamAdviser has some misgivings about the company, Payvea still has a valid SSL certificate that will protect financial and personal information. It would be okay to transact over the website or use the existing forms there.