UBC Bank Card is a credit card processing company that handles more than 110,000 merchants nationwide. Aside from credit cards, it can also process debit cards and e-checks. Moreover, the company sets up high-risk merchant accounts for the following industries:

The company makes sure that merchants in these industries can accept and process credit card payments so they can grow their businesses. UBC Bank Card does not only offer online credit card processing, but it also provides physical terminals for wireless solutions, e-check solutions, and high-risk processing. The company leases equipment such as ATMs, check readers, and POS systems.

UBC Bank Card claims to be accredited by the Better Business Bureau. It also has various awards, including one from The Nilson Report.

UBC Bank Card provides credit card processing solutions to merchants. It accepts all major debit and credit cards, including Visa and Mastercard. It is also a registered processor of Discover, American Express, Diners Club, and JCB. The company’s services are ideal solutions for retail merchants and restaurant businesses.

Traditional banks don’t approve high-risk businesses, which affects their progress. UBC Bank Card can process payments for all merchants regardless of the type of business they run. The company also works with merchants in the adult entertainment industry, as well as those dabbling in cannabis and firearms.

More than the services, UBC Bank Card also provides physical terminals. It has a wide range of equipment, such as the following:

Companies can lease or buy equipment for in-store or e-commerce operations. UBC Bank Card’s wireless terminals, for example, can accept payments on the go. Its check readers will empower businesses to process check payments from customers.

It used to be that only big companies can have a gift card program. UBC Bank Card can also provide such a program for small businesses. The company has a range of pre-designed cards that merchants can choose from. This is a nice marketing strategy for regular or high-risk businesses.

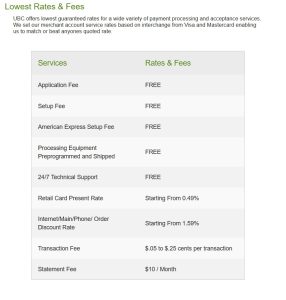

UBC Bank Card does not publish its exact fees. However, it provided a table of rates to guide merchants. The company said that application, setup, American Express setup, processing equipment pre-programmed and shipped, and 24/7 technical support fees are all for free. Its retail card-present rate will start from 0.49%. The internet/mail/phone order discount rate will start from 1.59%. The fee will be $.05 to $.25 per transaction while the statement fee is $10 per month.

The Better Business Bureau (BBB) gives accreditation and ratings to companies. Many clients decide to check out BBB first before trusting a company. On its website, UBC Bank Card said it is an accredited business by BBB with a rating of A+. However, even after a thorough search of the BBB website, there was no mention of a UBC Bank Card.

It is possible that UBC Bank Card has not updated its website with the latest information on its BBB accreditation and rating.

The BBB site does not have reviews for UBC Bank Card.

It is difficult to say that UBC Bank Card is legitimate because there isn’t much information about it. However, according to ScamAdviser, the website can be trusted. This means the site isn’t just mirroring another site or phishing information from users. It has a good trust score of 100/100.

ScamAdviser said that UBC Bank Card’s website has been online for a long time. It has a valid SSL certificate, too. The only negative comment about the website is that its owner is using WHOIS to hide his/her identity.

The company claims to be part of Deloitte’s Technology Fast 50 in 2008. Its website also has the Inc. 500|5000 logo. UBC Bank Card was also supposedly featured on NBC News.

Unlike other payment processing service providers, UBC Bank Card does not publish testimonials on its own page. It has no Facebook page, so there are no reviews or recommendations there either.

The information that can be found about UBC Bank Card is very basic. There isn’t much on the internet about the company aside from the information it has published on its own website.

UBC Bank Card’s website has a comprehensive list of all products and services. Merchants who are thinking of availing of this company’s services should look closely at the information on the site. However, since not much can be found about the company’s background and performance, merchants should proceed with caution.