Few things are as frustrating and provoking as finding that your funds have been made inaccessible to you. As a business, you might feel it’s your right to be able to access, withdraw, and use your hard-earned revenue as you see fit — and that’s true. Well, at least in part. The unfortunate reality however is that when you work with services like PayPal, you have to abide by their terms and conditions. Now, unless you really took the time to read that whole document before ticking that little box that confirmed your agreement, you might find yourself flustered as to why PayPal has frozen your account. Let it be known — PayPal doesn’t freeze accounts just for the heck of it..

Does PayPal Have the Right to Freeze Your Account?

Absolutely. If you’re using PayPal’s business tools to collect payments for your products and services, then they take on a part of the liability. If you’re doing anything fishy, then they become legally and financially liable for your shady transactions. So in a way, they’re kind of like a bank that tries to avoid involvement in anything that could damage their operations. PayPal provides a long list of terms that their customers have to agree to in order to use their tools. So even if you didn’t read them, as long as you ticked that box labeled ‘I Agree’, you’ve indicated your promise to abide by those rules and incur the penalties of violating any of the stipulated terms.

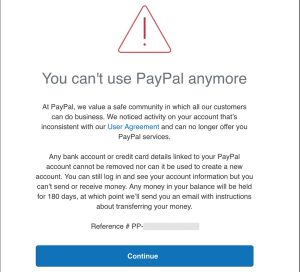

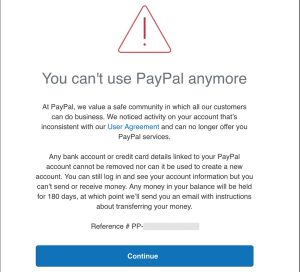

What Happens When PayPal Freezes Your Account?

A frozen account is simply a PayPal account with inaccessible funds. PayPal places limits on what you can and can’t do with the money in your account. For instance, in most cases, you might still be able to receive payments. However, more often than not, PayPal will limit actions that let you withdraw, send, or receive money. When PayPal freezes your account, they might send you an email informing you of the potential issue. You should also see a number of notices littered throughout your PayPal dashboard to let you know that something’s amiss. The payment solutions provider will give you options to resolve the problem so you can access your funds again.

Why Does PayPal Freeze Accounts?

Again, PayPal has some very valid reasons for freezing an account, so don’t think they’re just out to hurt your business. In case you’re unable to access your funds, here are a few reasons why PayPal might have decided to put limitations on your account:

- Unauthorized Use – Sometimes, PayPal will freeze your account to protect your best interest. Their platform uses some highly sensitive tools that detect when your security might have been breached. For instance, log-ins and transaction activity from your end that are registered to a different IP address or device raise tons of red flags for the platform, and give them sufficient reason to temporarily put all of your transactions on hold. PayPal can also put limitations on your account if the bank you have registered with them notifies them of a possible breach of your account security. Yes, these financial institutions will communicate during such an occurrence and will do what they can to protect your funds as part of their obligation.

- Violation of Terms – Here’s one of the most common reasons for your PayPal account getting frozen. Unfortunately, not a lot of people will read the fine print and thus end up unwittingly violating the rules and conditions that PayPal sets forth. If PayPal finds out that you’re using your account for activities that go against their terms, they can freeze your funds for up to 180 days. For instance, accepting payments for CBD products through PayPal is a violation of their terms, and will get your account frozen. However, for illegal activity that goes against the law, expect to have your funds taken away all together.

- Chargebacks and Refunds – It doesn’t matter if you’re issuing refunds with or without customer-initiated disputes. PayPal will see that as a potential threat. When businesses end up having to reverse transactions too often, that might be an indication that they’re selling products or services that aren’t as advertised. Just like any other bank or financial institution, PayPal prefers working with businesses that are honest and clean. Chargebacks could indicate that some form of fraud is happening, especially when they occur too often. As PayPal reviews your account activity, they may limit the actions you can perform.

- Suspicious Activity – PayPal establishes trends in your activity and uses these as a baseline to determine whether fraud is happening. That doesn’t mean you can’t grow your business, but they would expect that growth to happen gradually over a period of time. If you suddenly start getting hundreds of transactions after establishing a trend of just receiving 10 to 20 payments in a week, then that would raise a few red flags. Similarly, a sudden increase in the cost per transaction can force PayPal to temporarily freeze your account as they investigate. The same goes for chances in the services and products that you sell.

Can You Unfreeze Your PayPal Account?

If you leave the account freeze without resolve, then it can take PayPal around 180 days at most to resolve the issue on their own. Keep in mind that 180 days is the maximum for temporary account suspension (just like banks.) It’s also worth noting that if your account was proven to be involved in illegal activity, then they make take your funds altogether. For PayPal users who want to expedite the process, there’s the option of the Resolution Center. Here, PayPal asks you to submit certain documents and information to assist in their investigation. They might also call you or send you an email to ask for additional details necessary to determine the truth behind the activity that caused them to suspend your account in the first place. It may take up to three business days to assess the information you send over, and they may or may not ask for additional documents and details after that period. As you wait, you can view the status of the investigation through the Resolution Center at any time.

How to Avoid Your Account Getting Frozen

Needless to say, sudden suspension and limitation on your account can be a hair-pulling situation. So it helps to do what you can to avoid getting your PayPal account frozen all together. Of course, they may still freeze your account at their discretion — don’t get us wrong. But acting out these tips can help reduce the chances of having it happen.

- Read the terms – There are a lot of instances when a client might be able to avoid getting their account frozen if they had only known the terms of what they signed up for. Too often, we tick that little box without actually reading the terms and conditions, which is what puts people at risk of account suspension in the first place. Familiarizing yourself with what you can and can’t do should help you steer clear of issues that might get your funds frozen in cyberspace.

- Set a higher monthly volume – When you sign up the first time, PayPal asks you what you expect to make in a month. A lot of us will just tell it like it is, which is why most people would indicate a fairly small number. But there are instances when you might find yourself face to face with a sudden influx of purchases — such as when your products or brand goes viral. Setting a higher monthly volume at the start can help prevent red flags from popping up in case you’re met with increased sales.

- Make smaller, frequent withdrawals – Moving large amounts of money after a period of inactivity can be problematic for PayPal. So instead of keeping all of your money stocked in your account for months before deciding to take it all out, make it a habit to withdraw small amounts more frequently. This won’t only appear safer to PayPal but also lets you take your money out of the platform without setting off any alarms.

- Communicate with them – If for instance, you’re launching a new product or if you’re expecting increased sales for a time of year, then you can go ahead and let PayPal know about it. Communicating the potential changes in your transaction volume can help them anticipate the change and give it context. Of course, it’s not all that easy to get a response from them anyway. But if they do decide to freeze your account and you have receipts of conversations informing them of the expected influx, then you might get your problem resolved sooner.

Getting Around a PayPal Account Freeze

It’s true that getting your account frozen might be the ultimate bane of business ownership, but these things happen. Understand that PayPal will not freeze your account just for kicks, and they will have a solid explanation as to why they might do it. That said, it’s important that you tread lightly and transact with caution to avoid tripping any alarms and triggering a sudden account suspension.